Play To Progress: The Solution To The Fundamentally Broken Play-To Model.

This article covers how play-to-earn models are broken and why a play-to-progress model is the apparent next evolution. It's is a little more abstract than my other articles as the definite answer is not yet clear. Join me in 2022 as we journey to find a conclusive answer to all of our play-to questions.

Before diving in, let's clear up these terms we will need.

GameFi: the industry vertical where gaming and decentralized finance merge. At this stage of the 2022 market, things have not yet reached the stage of real gaming and are merely game theory. The depth may evolve, though the underlying systems will remain the same.

p2 instances: a model that is reliant on an audience action. Without players, there is no value-creating action. Liquidity does not make these systems run; people do. (these are 100% chicken-egg paradoxes; queue the requirement of hype or significant value props.)

Play to progress (p2p): an evolution of the play-to-earn model that removes the financial component of return for an inner-ecosystem valuable instead. The focus of the deliverable is not to serve as exit liquidity but an increase in experience quality in the future.

To sum it up, play-to-progress systems are designed to reward exploration and utilization of the economy and its mechanisms. Achieving this can be incredibly simple, but it also can house deep systems with highly complex instruments. When building a play-to-progress system, the ability to create a closed economy still exists—financial mechanisms and incentives to draw and direct liquidity in ways beneficial to the more miniature ecosystem.

However, a play-to-progress system does not mean it's an entirely valueless ecosystem or experience, simply that the outcome of immediate financial exit from deep within the system does not exist. To a more extreme extent, players cannot buy the valuables within the ecosystem without using the already-earned token.

What does this mean?

As we get deeper into the system, our closed economy becomes more abstract from the financial value and more towards the time-appended value. As a business, the goal is to offer immediate gratification for supplying the ecosystem liquidity and reward the future action of protocol involvement and ecosystem interaction following the initial purchase. If there is no long-tail payoff of any kind, getting the initial liquidity needed to bootstrap a protocol is infinitely more complex.

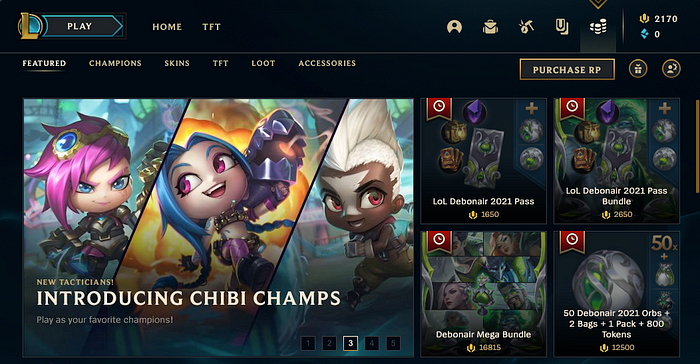

Rewarding progression isn't a new need or system model. Many of the most popular video games have been doing this for years. What's more, the unlocked functionality and deep player integration led to extreme popularity for many organizations that implemented systems like this.

A play-to-progress model turbocharges player engagement while removing the perceived negatives of the micro-transactional experiences that everyone goes through with classic mobile games. In even more recent years, this focus on downline experiences delivered has propagated out to more traditional video games like the wildly popular League of Legends.

While this model has proven to be highly efficient in many ways, nearly every project in the GameFi vertical has decided to ignore the wisdom of the technology giants that figured out how to extract millions in liquidity a long time ago.

There are some exciting examples of play-to-progress in Web2 and Web3. Most notably, Battle Passes introduced in nearly every large multiplayer game currently running. With Battle Passes, you make an upfront purchase to gain access to a branch of functionality. As players progress, they receive rewards for their efforts.

- Sometimes the rewards are predefined.

- Sometimes they are random.

- Sometimes they can be customized by the player.

The variation in challenge difficulty and the ensuing rewards is all part of the fun! These massive companies are not adopting the model just because they're copy-pasters. They're chasing profits, but more accurately, the most efficient system.

In Web2, there are no mechanisms to monetize or even withdraw the money spent when you deposit your money. A purchase has been made, which was the end of the transactional experience. Such a simple experience is an easy one for a buyer to look at and say, "oh, I don't need that." However, when one decision becomes 20, the tantalization of future functionality is enough to drive many players deeper into the system.

Everything else past the first transaction is the usage of platform functionalities. The game's creator received all your money the second you made that purchase. Yet, they've extended the spending period into a multi-step process that allows each person a unique path of spending in return for an unforgettable experience of account progression. Why? To create memories and lasting mechanisms of personal callback.

Creating memories is easier said than done, though. So, what can do we do to improve our odds of building a profitable and maintainable system based around this concept? Utilize multi-layered systems. Within a system with multiple layers, each player can be offered a unique experience that they tailor to fit their play style, cosmetic preferences, and overall objective. Understanding this concept can be difficult without a reference point so let's rectify that absence of context.

Assuming you have no knowledge of the video game industry or existing market designs, let's look at a simple example model.

Imagine we are playing a game and to get started:

- You put in USD

- You receive stars (Unlocks 80% of functionality)

- You can buy diamonds with stars (Unlocks final 20% of functionality)

We can ignore 99.99% of the model details for now because the vital part of this model is the realization that a functioning decision tree is not a simple A/B situation the players encounter.

A buyer is not faced with the question of: "Do I want to hold stars or diamonds?" Instead, this becomes a question of "Do I care about/value this functionality I can access?" — There is a deeper layer that leads us to realize the question is really "How much value do I append to my time?" but we will get there shortly.

The deeper a protocol can integrate an individual, the more resilient the market to liquidity mass-exodus events. When building a play-to-progress model, this new delivery of security is the first thing gained by the protocol, but it's not anywhere near the last. The benefits of a better-defined system continue rolling in each step along the way.

Even with a highly naive and straightforward approach, there have been situations where a protocol achieved this simply through the formation of exit friction and the protocols' attempts to slow exits. However, a protocol in charge of exits is sure to dump. A protocol must be able to give its holders that ability. A player must choose to slow their departure themselves, and the protocol must be ready to respond. This situation cannot be flip-flopped.

Even with a highly agile system, a player exiting a multi-tiered system faces a far more significant challenge when leaving than they did to join. Exit crunch becomes more impactful as the GameFi protocol offers tangible value and exploits the exit route optionally. The players of a system like this aren't forced to hold their liquidity deep inside the system; they choose to.

Let's look at an example. Before continuing forward, please take a second to look at the system below, and then let's continue forward. If you skip over the general understanding of what we are diving into, you will be incredibly lost throughout the rest of this article.

In the first model, we have the typical flow that we've all become familiar with overtime. The Ponzi-like structure in which holders and players must constantly have a stream of liquidity flowing to drive forward the ecosystem's progression. Breaking it down into the raw components of:

- Acquiring flowers

- Staking flowers

- Receiving more flowers at determined APY

Immediately we are faced with a difficult question to answer. Are the flowers you're receiving worth the same? Fundamentally the answer is no; all flowers have been devalued because now more flowers exist in the ecosystem than ever before. Regardless of a change in demand, there is a change in supply, and thus the underlying value of the flowers has changed.

However, in the second model, a visualization of a simple play-to-progress game, we have a living and breathing system that produces and consumes based on the player's interaction. Let's walk through it real quick into the flow of:

- Deposit real-world money into the pool for deeper protocol liquidity.

- Receive player character.

- Receive closed ecosystem token emissions as liquidity reward.

- To play the game (accepting missions), a player must have a character and sufficient closed ecosystem tokens to put out a fire.

- Upon defeating the fire, the character receives (food/family/money) which are all used to unlock functionality deeper in the ecosystem.

A play-to-progress system does not have to be a video game, though it is comparable to the user experience. Thus, this type of player experience is known as game theory, where skill level boils down to the players' ability to min-max the system put in place. Which do you think makes more sense?

There is something vital to note, though. The collected goods are not always redeemable for real-world money in this new model. Instead, the accumulation/utilization of earnings increases the value of the acting character within the ecosystem. For the smartest, this may appear non-dilutive; however, that's not the case, and you will see why soon.

In the NFT space, we have alternative systems where projects have reverted to simpleton bonding curves that immediately exit-crunch all holders. Then they get pumped by influencers using their followers as meat. What happens? There is no beneficial exit opportunity, and thus the floor cannibalizes itself as all holders realize the way they come out on top is by dumping on others. Read Wolf Game (Holdings of zero).

In Wolf Game, the excitement comes from never knowing how much your wolf, sheep, or wool will be worth or what will come next. It's called a Risky Game for a reason.

- Will everything be worth zero?

- What strategy do I need to enact to prevent losses?

It's not a matter of what decision I make to be the best. For all but a select few, the question devolves to how do I minimize my losses while collecting fractions of the unrealized profit amassed. For risky games, that is through the "theft" of other holders' investments.

This system is not accurate just for Wolf Game but also other p2e games as well. If it's a Risky Game, it is this simple. Don't let anyone convince you otherwise; they are merely the wolves of that ecosystem.

A more large-scale example is Ohm (Holdings of zero), a DeFi protocol striving to become the digital reserve currency that faces the same issues. With an insane APY at launch, the project strategically decreased emissions and accumulated the needed liquidity. Unfortunately, that happened at the cost of the existing holders, as the team misled many to believe the APY was sustainable or that if they just held long enough, their investment would recoup. Yet, the price continues to plummet to zero.

Now, as the value of the actual product of OHM is being realized, getting holders that believe in the mission + are fully incentivized not to use their liquidity like mercenaries are proving to be near impossible. Why? Because Ohm forced an 80% loss across nearly every holder, and the suggested solution was: "Just hold longer."

In Risky Game systems, even if you do win, to cash out, you are hurting your future and likely the value of your existing holdings. You are suddenly not as invested in the ecosystem because you realize a recent win. Oof. There exists not even a microscopic level of holding security for the player in a system like this. Even if they want to hold, they shouldn't.

There is constant sell pressure and fear of lost opportunity on both sides.

The situation is quite simple, really: Mercenaries win a war. That is to say; liquidity will follow returns; it does not care how nice of a king you are.

But, this does not mean you must bend the knee and give up on your morals, goals, or dreams for this protocol. Machiavelli said it best:

… I repeat that not gold but good soldiers constitute the sinews of war. Money, indeed, is most necessary in a secondary place; but this necessity good soldiers will always be able to supply, since it is as impossible that good soldiers should lack money, as that money by itself should secure good soldiers.

- Machiavelli

The first step is getting the people, and the second step is getting the money. We mustn't flip the situation. If you can't amass both, the outcome is always implosion when it comes time for the phase of large-scale adoption. Liquidity incentives are too strong in this space for anyone with a sizable stack of funds to be docile in the hunt for the best and most long-term return.

While consumers can perceive the intent of creating a multi-layered system as unfavorable or purely capitalist, your protocol can immediately stand out from the rest by adopting this perspective. We're not in Web2, nor are we in 1970. We can do better now.

In GameFi, this model unlocks mechanisms that previously would have been under constant attack by the functionality-created sell pressure on the top-layer ecosystem token. Understanding the generalized problem as we have just walked through it is only the first step. The next step is understanding the fundamental solution to all these concerns: Aligning incentives.

By aligning incentives, the concern of liquidity exodus evaporates with the tangible value already delivered. With more trust and value comes the ability to drive more liquidity, which is the real backing of all larger-scale protocols. Yet, initial liquidity must be generated, especially for GameFi models. A protocol may be pure in intentions; however, they still need funding. Do you see what Machiavelli was talking about now?

If this is the case, then the question becomes, how do we achieve this? As it stands, to tackle this problem in the inefficient market, many projects resort to launching with financially-unbacked tokens. Almost always through a straightforward token staking mechanism where:

X token staked= Y token accrued at Z period

Even with no experience in the space, the obvious question of "Where is the liquidity coming from?" pounds within our heads. Typically, the liquidity is generated through the exploitation of the most passionate holders, leading to the great collapse of systems that have deep-rooted systems of support.

Today, there is a comical reality in which the protocol supplies initial liquidity to fund the initial price discovery period. That is incredibly inefficient usage of capital. There are so many better systems than deploying a token with the plan of:

- Protocol supplying liquidity.

- Holder accumulates ERC20 token through NFT token staking.

- Holder sells ERC20 tokens while maintaining staking.

- The protocol has severely limited its upside while hurting the inherent health of the treasury, team, and growth potential.

A GameFi project reliant on this structure has a constant dev-labor cost that will wreak havoc anytime the protocol needs to scale up in deliverables, amount of contributors, overall quality, etc. Even in the best of situations, the team may be getting their vested tokens, but they can't dump. Dumping is against the morals of building something genuinely great.

- How can a team without security efficiently operate while maintaining the ability to build long-tail value functionality?

- How is the team aligned to build a deep-rooted value system?

Like holders, the project needs a way to build tangible value on both sides of the equation so that all spots of the spectrum can operate most efficiently. Aligned incentives are one of the keys.

Being built upon such a simple system, nearly every token released has been a race to zero. The majority of tokens launched, whether intended or not, serve as the primary mechanism for holders to realize their liquidity exit.

By doing this, the biggest holders enter a paradoxical situation where they must realize some extent of profits but can't do so without directly hurting their investment. Holders can't quickly realize exit liquidity, and because of that, the market acts extremely irregularly as individuals buy and sell on emotion.

People are liquidating through emotion rather than logic.

Though, that's not because every individual holding is an ape incapable of making a logical decision. Instead, the ability to be a part of a logical system does not exist when forced into exiting with an incentive that directly detriment the quality of their remaining investment.

This situation is known as a simple case of Prisoners' Dilemma. If we take this further and introduce an expiration period to the driving force, we reach a Tic-for-Tac Market. Which again, isn't a long-term solution, but is a model that currently offers more longevity than the former.

The solutions to this problem aren't precisely straightforward, nor are they a desirable route for every project that encounters this problem. Though the problem as a whole is complex, the complexity of a backend system to avoid this is entirely approachable when a team and supporting holder-base are agreed on the overall goal behind what is being built. Without aligned builder:holder incentives, building in this manner produces mechanisms that are often so far down the road that the industry goes through five cycles before the protocol is launched.

In the beginning, the actual product being delivered is not as crucial to the equation as the "why" a protocol delivered a product. (For example, the entire Ethereum ecosystem does not need to realize the goal of the protocol entirely to incentivize and inspire the expansion of the mission.) "Why" is how you get people. The what is how the protocol and holders make money. The "what" can always be changed; "why" cannot.

With incredibly aligned incentives and missions, long-tail functionality can be built that helps facilitate a higher level of efficiency as the system and audience support scales. In short, we're done with bandaid solutions. Burn them all. It's time to focus on solutions that address the problem rather than just delaying the inevitable.

To achieve this, it makes sense to start building our system by understanding the benefits of aligning incentives with the holders to a more significant extent. To do this, we have to shift our perspective of the ecosystem that is being built.

We've been taking this topic pretty objectively this far. To dig deeper, we have to step into the system of a bit of abstraction followed by what may feel like a convoluted organization until you've had some time to form your opinion. Moving forward, we will create new systems of visualization to help you better understand things.

To cover the ground level, these concepts are not entirely new as they have been explored in academia for upwards of fifteen years. However, there are pieces of the system that even the brightest minds of the industry never expected. For the last 15 years, the argument against any form of long-term play-to mechanism was that there was a constant balance of audience support and being able to deliver the next piece of value that continues driving the closed economy forward. This boiled down into two primary arguments:

- Money is not enough to justify personal loyalty. Entertainment and fun are valid requirements of a system seeking longevity.

- There are no interest rates or overly complex systems.

These arguments don't hold as strong today. We can officially say the ability to build complex systems with built-in "interest rates" has been achieved. An emissions schedule with complex tokenomics has been released thousands of times. While we may not have solutions yet, this problem can be addressed, and we can begin exploring new lands. We don't have the answer, but we do have the ability to find the answer, which is all that matters.

If we remove the financial mechanism concern from the equation, that leaves us with one primary argument against play-to systems: A system has to generate a genuine level of entertainment to remain a viable system, whether it be financial or for a fun-focused player.

- Achieving this isn't easy.

- Quantifying this is difficult.

Approaching this straight-on will result in analysis paralysis that prevents us from ever making any real progress. So how do we do it? To assist in organizing this thought, we are going to build a new classification I have been calling: pSystems. This adopts the idea that a person cannot reach p[n+1] if the driving mechanisms of p[n] have not yet been utilized.

That is to say: A player cannot benefit from a deeper level of the funnel if a player has not experienced the layer above it. While a top-layer player does not benefit from deeper layers, they also aren't exposed to the implemented loss mechanisms.

We can build a funnel that concentrates real and virtual liquidity while capturing the essence of time most efficiently with this simple rule. To best achieve this, we need four core layers in our system to build a funnel that operates such as:

Looking at this and immediately understanding the entire system is tricky. Instead, let's go ahead and walk through the whole funnel, and then we can dive into the details of each layer.

In a standard flow of interactions, we can break it down to:

- p1: Where the depositing of liquidity takes place

- p2: The primary action layer of the protocol

- p3[x]: The constantly evolving layer of options each player faces

- p4: The layer that prevents over-production through losses

With these pillars in place, we can focus on building within p3 and p4 while enjoying the security benefits created through the stability of p1 and p2. Functionally, you can imagine everything before p3 as part of the onboarding experience.

While building our system, we must assume that layers are added as needed/discovered. There is no way to predict how deep the funnel will go, so we will not waste our time carrying that concern. Instead, we will assume at all times that there are deeper layers we haven't yet discovered. All systems become deeper by layering the levels of functionality into previously unavailable verticals as the scale of audience and protocol increases. We have to accept that we have not reached the limits of mathematics, theory, or even experience in scenarios like these. The only limitation that has been reached without a doubt is the level of research effort a typical GameFi creator is willing to devote.

There will be new experiences and models never before seen as we eclipse in the financial-digital era. Fear of not being prepped for an issue cannot stop the progression. The experiences that have been built in GameFi are just scraping the surface of entry-level concepts. However, this does beg the question of why have so many protocols created the precise flaws we've known to be true for so long? In short, they are focused on liquidity accumulation. Technically, they achieved their goal, just as the cost of their audience.

- What if the audience doesn't have to be exploited?

- What if we want to do better?

That's where the usage of a pSystem comes into play. It can be challenging to imagine this system just with words so let's look at a real-world case study.

Defi Kingdom (Holdings of zero) is a living example of this, a DeFi game built around useable NFTs. It is potentially the best example of GameFi that has ever existed and puts it on display. If you've been looking for a pSystem to experience, this is the place to go.

These systems start at the top layer with financial mechanisms. We need to incentivize the depositing of liquidity with top and bottom layer accumulation options. For the DeFi Kingdom, the system's liquidity backing comes from the decentralized exchange (DEX) that is baked into the onboarding experience. To keep things simple, a DEX is a decentralized exchange that facilitates the trading of two tokens, sometimes peer-to-peer but most often into a collective pool.

With a DEX in place, there is more liquidity exposed to the ecosystem that further deepens the moat of liquidity a game ecosystem can rely upon for future movement. But, the exposure to temporarily high returns isn't precisely tantalizing for an investor that isn't an absolute degenerate. If that is all the exposure that comes from being in the DeFi Kingdom ecosystem, then people still don't have a reason to accept a lower return on the money they deposit.

For DFK, this is solved by introducing a closed economy token, $JEWEL. There is a distribution schedule and lock up for the closed economy currency, $JEWEL. With the introduction of $JEWEL, the system does not just have the goal of liquidity accumulation but also promotes the player interaction of the deeper system to realize the value of the token they are yielding. It's an excellent solution for DFK.

However, implementing a DEX to provide needed liquidity will be highly short-lived on the grand scale of the industry. Not every project should bootstrap a token exchange with or without APY-juicing the entire system. There do exist a ton of other solutions to this problem. For example:

We do have the ability to dive into these other solutions. Yet, the exact details of the system that proves to be best will be different than anything that has ever been built before.

Another essential thing to remember is that while liquidity needs to be provided, multiple faucets can fill a single treasury/vault. It doesn't all need to come from the same place. Liquidity accumulation isn't a problem that is impossible to solve; it just takes a little critical and creative thinking.

Do not be led astray, though. It's not exactly as simple as implementing more functionality that rips the riches out of the hands of the holders. Without proper planning, the same conclusion is always reached regardless of the initial complexity, speed, or market reaction: Absolute death.

Consistent liquidity and closed economy funding will be a challenge forever; however, that cannot stop research. Even the largest governments in the world face this issue. It is simply the nature of a system that attempts to collect its participants' financial and time value. Fundamentally, if there is a significant issue here, there is a deeper-rooted problem we haven't yet discovered. Let's move forward and assume that the absolute best model option available is being utilized at the time of launching, and liquidity for p1 is decently stabilized.

With a p1 that a protocol can be confident in, what do we do with the feeding mechanisms that have been built? Step into p2, where the focus is on promoting spending the closed economy token earned by depositing liquidity into p1. For Defi Kingdoms, that is Heroes.

To progress deeper into the system, a player must acquire a hero (primary actor) by consuming the closed economy token. This is only the start of the system we are building, though. With that in place, we now shift our focus to the one simple rule as we move deeper:

- The layers only impact a player they are interacting with.

Remember, we build a system designed to reward progression rather than simple accumulation. A more straightforward way to put it: Rewarding liquidity & time loyalty. This concept alone isn't enough. To help reach a state of stability faster, it's crucial to implement higher velocity mechanisms for the players that explore deeper into the ecosystem.

This means that as a player journeys deeper into the system, they should be exposed to higher returns, whether through increased opportunities or increased magnitude in opportunity is not essential. This is where p3 comes into the equation. In general, a pSystem is designed to create a financial-return experience similar to:

Given perfect play, a deeper player will experience a higher financial return. A higher return is not guaranteed. What is guaranteed is that the deeper players have higher exposure to profit-generating mechanisms and opportunities. That does not mean every player will choose to interact with that mechanism, nor does it mean they will achieve 100% utilization.

Within p3, there is the ability to protect the health of the protocol in a laundry list of ways. There are countless mechanisms to remove the guarantee of additional return while introducing more significant and genuine incentives for deeper-layer exploration. While it may sound oxymoronic at this stage of the article, this is the surface of the fundamental solution to the ever-expiring clock: To have winners, there must be losers, even if it is a closed economy. The benefit here, is that it is a closed economy. The impact of losses can be managed in ways not achievable in the real world.

With this understanding, let's keep going deeper into the layers of how the best systems function. Remember, it is a system designed to reward progression rather than simple accumulation while still utilizing those building a war chest as a faucet into the ecosystem.

With p1 and p2 in place, game aspects can be unlocked with the introduction of abstracted functionality and closed economy action. It's time we build the mechanisms of p3.

- This system is not a simple A > B > C

- Instead, this is a system of A > B > C-Z

Abstracting away from money is not the goal. The goal is that this occurs naturally through such depth of functionality and player consideration. Once a player reaches the gameplay mechanisms, the more options they are faced with consequently weakens in the association to that original dollar by a larger magnitude each step of the way.

This brings us to potentially the most exciting part of this situation. If the goal is to solve the financial problem, the only real solution that brings longevity is to remove the liquidity requirement entirely. To achieve an economically viable system, we can't build a system that has an economics-driven ethos. A system designed around longevity is better served to quantify things in terms of fun, time, and fulfillment which will generate far more considerable sums of liquidity and profits come due time.

At this point, it may feel like we've stepped into the land of theory. Oddly enough, the measure of utility and fun can be calculated. With the complete understanding of how to pull this off within your system, immediately you're miles ahead of other projects/protocols launching. How can you plan to generate memory creation if you don't know how to calculate for that? You can't.

To best understand this, we must quantify things in a measure of utility and time. Every model will range in complexity of the mathematical theorem that supports it. However, a generalized tool is maintained across the most efficient systems: Utility functions.

To illustrate this, let's break down the idea of utility into a more robust example so that we can draw off some real-world connections.

In real life, our players maintain many different personalities at any time of playing. If a player has more than one hero, they have multiple strategies (avatars) simultaneously running in parallel worlds. However, the extent of the players' personalities does not stop there, as we do have to consider their real-world position. Simpler said: "Every player has [j] avatars in [i] worlds."

When you think your idea is too small, just zoom out.

- You impact so many lives.

- Protocols amplify this to the highest of extremes.

With the interaction of player-avatars, there blossoms a network of independent worlds filled with different decisions, outcomes, returns, etc.; it does not matter if the world is real or virtual.

So, before we can even start building solutions, we first have to understand not just who the audience is but how that audience is impacted. Predicting the actions and feelings of humans is one of the most challenging things you can attempt to accomplish. It's a near-impossible feat, so let's focus on refining our perspective.

We don't need to pull a new system out of thin air to achieve this. We can rely on a tool that has been used to frame the perspective of market designers since the introduction of digital trade.

Let me introduce you to our good friend: Virtual World Classifications. Before diving in, it is critical it is noted that this classification is designed to focus the perspective of the creators to a single point, not the holders or players.

Virtual world classifications are designed to return simplicity by focusing on the person, the world the mechanism functions in, and then the money going in and out. We will consider whether a mechanism has impacts primarily focused on the real world (R) or a virtual (V) one for each of these verticals.

If we categorize each mechanism built within a pSystem, the ability to align incentives and achieve extremely delicate goals is far more manageable. How is it more accessible? Well, displaying that is quite simple when using this classification system. For example, in a pSystem:

- players participate in the community as virtual avatars

- and their activities take place in a virtual world setting

- and use virtual money

Thus, we would classify it as (V, V, V). We know the impacts are limited to virtual consequences, plus we will take the knowledge that every natural person spends time to be a digital avatar. Finally, we have a clear image of who we're tailoring the experience for and how.

In an item-purchase-based ecosystem, the people and the world are virtual, but real-world money is utilized, so it is (V, V, R). Immediately we can identify that the impact a player feels is far more significant because there are real-world consequences. All configurations have their benefits and downsides.

Everything involves people in the real world, and we cannot forget that. Consequences and rewards are felt everywhere and the magnitude of that effect is designed by the system in which the avatar is found. There is no escaping this reality or creating a system not rooted in reality. We have concrete proof that we have far more significant impacts in our digital systems than in our digital remnants.

With this understanding, the number of potential routes for the protocols market design becomes far less overwhelming. We have the perspective needed to build systems with this goal, and we can begin building the desperately needed solutions.

Instead of picking apart each potential method that we could implement, it's easier we walk through the bigger picture that a creator can build to support all paths. The core of this starts with the simple idea that all mechanics the player is exposed to throughout their experience can be simplified down to a straightforward Policy.

There exist one primary constant in each of these policies:

- as we progress through the system, the primary cost increasingly becomes time (more accurately referred to as labor).

With the increased opportunity exposure for deeper players, we now have a system that increasingly rewards them as they spend more time in the system. With this elementary rule suddenly, we've defined the broader expenditure curve of our closed economy to look and function more similar to:

By doing this, we've created a new set of issues. We cannot consider the problem squashed as rewarding loyalty does come at a massive cost. A system that rewards deeper progression is at the behest of overproduction. There are no large-scale functioning systems where this is not true. To be better understand why this is the case, let's break it down:

- We are a hero and go off to fight monsters.

- We level up and start getting better loot.

- We don't use the items we had previously acquired while accumulating a deeper war chest.

- Now there is an unused supply of an item, and new players must have it. The instances of this item in the world increase and usage decreases.

- Welcome to the land of overproduction/underconsumption.

It's an oversimplified illustration to see how everything quickly reaches a state of being obsolete in a system designed around player progression. This is one of the downsides of a pSystem and one of the things every system will have to address somehow.

How do we solve this without removing the ability to make something profitable or fun? That is quite literally the question. It's not as simple of a problem as the rest. There are ways to mitigate overproduction. With overproduction comes a suite of economic impacts and models that are far too high-level to discuss in this article.

The critical thing to realize now is that there must also be loss mechanisms because of the growing reward mechanisms. Loss has a highly negative connotation, but the loss experienced does not have to be financial. The loss experienced can be lost access, lost quality, lost magnitude, etc. The best implementation entirely depends on the system being built within; however, there are mechanisms to control both sides of the equation. What goes up must be able to come down. That is a law of nature and a simple one to remember.

As we progress further into the depths of complexity, we must remember at all times that these are just policies. None of these policies should be a top-layer action because they objectively do not bring enough value to be a foundational piece and just assist in the balancing act. The goal is a system of significant stability and gained longevity. To achieve that, we operate with two simple understandings:

- Profits protocol-wide can consistently be increased.

- Nothing can unturn time back.

There is a shortage of resources in the overall scope of play-to-earn, game theory, etc... There is not yet much evidence-driven proof that can be relied upon to identify systems' weaknesses. So, the ability to rate a policy typically does not exist until tested in the real world. With such an infant stage industry and the near-refusal from many industry leaders to educate their audience or attribute their predecessors, it remains nearly impossible to act through any sense of wisdom.

Unfortunately, this is why we will experience every wrong evolution before reaching a better stage. On top of that, the progress made industry-wide is not linear. There are policy branches that protocols choose to make their cornerstone that often create a fractured foundation. Each time this happens, the industry is not stepping forward once; it is stepping backward three to tens of times. Protocols evolve far slower than platforms, and this is just one of the many reasons/compounding outcomes.

Although we often do not have the experience to rely on, these are the concepts we will continue digging into deeper as there are only two potential answers to this research:

- p2 systems are fundamentally broken

(and potentially a result of a capitalistic system) - No one has found the right solution

How do we find the solution then? How do we prevent this from becoming such a behemoth of complexity that our team cannot even work on it? How do we prevent the audience from getting bored?

Generally, policies will become most productive when they are thought of and utilized in a more categorical manner. These policies are designed to achieve a different result while becoming more robust as each new policy is implemented.

Still, the fundamental basis of many policies can be torn apart into core aspects. Hence the assistance of categories when building a system as complex as the ones we are discussing today. Keeping them tied close to reality, we can continue building the pillars of success for a pSystem we will move forward with:

The introduction of categories brings a broadened scope of what we've been talking about thus far, so let me reset the room real quick. Almost all p2 longevity-focused protocols are built to reflect the models of a real-world local currency.

A local currency is unique because it's not an accepted form of tender in all parts of the world. There are currencies not heavily supported by other parts all around the globe. Does the lack of global support make the money less real locally? Not at all. They can still go to the local market and buy and sell goods for the local currency.

Let's frame this in the perspective of the game Monopoly. Monopoly has an ecosystem currency called Dollars. We can't buy a house in the real world, yet we can buy a plot of land in the game and subsequently earn more Monopoly Dollars when someone lands on your property. In Monopoly, the ecosystem dollars are just as real as any local currency in the real world. This is even more true when we bring the circle full-close and remember that any digital action also has a real-world consequence.

So, how do we drive the economic activity of a closed ecosystem currency? Through the introduction of industries, or as we know them, policy categories.

Let's start by diving into the possibilities of agricultural policies and their effects. Imagine that we need to implement a system that allows for constant farming. It may be skill-gated, limited by the consumables in the actor's inventory, or any other number of other access keys. The important thing is that there is some level of cost associated with a consistent baseline return of something else.

As is the case for all policy categories, there can be variation in return, there can be variation in access, there can be variation in duration. This variation is found in the ecosystem and within the primary actors such as the Heroes. The focus of a policy is the outcome. Any ramifications can and will be handled by another policy.

Public policies are focused on controlling the inflow of liquidity into a system. With this, the price of items can be better maintained through tricky utilization of the exiting mechanisms within the ecosystem. This is the equivalent of setting a base cost for heroes to allow for a more consistent entry-point. This is the equivalent of establishing a base price for consumable or quest-earned items to a more extreme extent.

Accomplishing this on the base level of functionality is easy compared to the other problems being tackled simultaneously. Let's continue with the perspective of DeFi Kingdom and imagine that our primary focus is to maintain a simple and cheap on-ramp. To achieve this without exorbitant running costs, we will implement a mechanism that introduces players to all types of instruments—a journey from p1 to p4, in a matter of minutes.

Imagine a player joining the game is given a tutorial character. With minimal functionality, this player can earn the closed economy currency to a limited extent.

With this earning, when a player is ready to complete the tutorial and start their real character, they must burn their tutorial character in return for an additional bonus in the closed economy currency.

Immediately, the on-ramp is controlled, and the gate of access is no longer financial. Now, the system running is merely a question of time spent. As the system scales, the cost can increase, resulting in the initial farming requiring more on-ramp labor. It's a brilliant way to introduce a mechanism of stability and education. Are you beginning to see how everything loops back to player time spent in an ecosystem?

Following directly off the idea of time spent, we reach labor policies. In 2022, before bots have reached their full capability, labor is sadly measured and rewarded based on time spent. Actively, this is a delicate subject to build around because it is so easy to quickly create a system that is riddled with concerns of breaking one's own moral or ethical bounds.

Throughout the progression of newly launched pSystems, we will invariably see specific protocols exploit the economic states of the real world. Semantically debated slavery is out of bounds for me, but more importantly, it is an inherent detractor to any new player being onboarded.

A key caveat to this is that not every labor policy is inherently exploitive. There are implementations of labor policies that are fair to the player and all other parties involved. The refusal to cross moral bounds is limiting in some regard, but it is simplest to think of it is as:

- A labor policy must be focused on the time spent by the player that owns the primary actor. Creating the situation where another person spends that time for a cut of the reward is not a good implementation under any guise.

Perhaps the most interesting thing about labor policies is that almost every policy boils down to some form of labor. It is an inescapable wheel in society that is constantly running a million miles per minute. The best labor policies are often a tiny part of a more comprehensive policy.

With the implementation of primary driving forces, we can now introduce economic policies. These policies are the core of many of the most popular game mechanics in 2022, where you are introduced to mechanisms like consumption, durability, planned obsolescence, and a myriad of other concepts that literal scientists have crafted for years.

One of the least aggressive mechanisms falling into this category is cosmetic items such as fashion. Fashion trends are constantly evolving, which is only accelerated in a digital society where trends are growing both in the natural and digital worlds. It's no longer a simple consideration of what shirt to wear. As digital ecosystems evolve, they experience periods of being ahead and behind. Now, a digital piece of fashion is entirely dependent on the delivery mechanisms of mentioned fashion piece.

Without being forceful to achieve obsolescence, the ecosystem maintains momentum as long as the platform as a whole has kept the met all top-layer requirements.

Regardless of the economy put in place, the poor become poorer as the rich become richer. In systems where liquidity is like poison, it's vital that other pieces of the system introduce the stability. Physical wealth is relative to each person, yet that status is also a part of the larger system. We cannot change that; however, our approach must be aware that this is the reality of life. There is no economy that everyone becomes the richest. To consider someone rich is to consider someone poor.

Systems that reward loyalty exacerbate this specific problem. The players that are most loyal and utilizing the mechanisms in place are the ones that are limiting the amount of growth that can take place within the system.

As players become richer, there is less immediate incentive to decrease their holding position. Without limiting the amount of money an avatar can accumulate, it is challenging to limit over-production. The significant overproduction and underconsumption create a crooked system that is nearly impossible to fix without introducing new policies. As the entry gap grows, so does the amount of time it takes to get into the game. Thankfully though, this isn't a dead-end.

A system that has an almost immediate effect in the digital space is immigration policies. When large amounts of liquidity move into other ecosystem areas, the poor become more affluent. When expertly used, it can have incredible effects. Not only does a mass migration rejuvenate a system that was bursting at the seams with overproduction, but migration can seed a new system as well to offer a deeper layer of long-term security and stability.

Before moving on, it's important to mention that there are not just policies to increase stability. Policies are multi-faceted at almost all times and cover many industries while using many concepts that can be boiled down to basic similarities.

An economic policy known as Real Money Trade (RMT) introduces the ability to mitigate overproduction with a more potent vehicle that promotes inner-market action resulting in increased stability. This does not remove volatility; it increases efficiency and synonymously the rate at which the "real price" is discovered.

Implementations of RMT are extreme in scale due to the number of secondary policies that must be in place to backstop the activity of the introduced market. While the scale of development labor may be large, it does not mean that it moves up in labor importance. Still, no matter the scale, a policy cannot be a primary mechanism.

RMT is a highly controversial topic because it is the crucial distinction for much of the non-adopted market. A system designed explicitly around the support, and even lack of RMT often result in profit-generating machines. Even with the introduction of RMT, we are doing nothing but increasing the active clock of the game. It's not worth digging more into because it's a policy we can employ and nothing more.

As you can now see, the number of policies available to implement is infinite. The options only stop appearing when we stop looking. The best solution for the protocol being built will never be the same policies another protocol used, and if it is, the newly built protocol probably doesn't need to exist.

The success of a pSystem is of course reliant on many more things than just the ones we've covered. They are a little mini-economy that is moving at the speed of light no matter what you try to do to slow it down. Welcome to the particle accelerator that is play-to systems.

So, what's the conclusion here? Overall, it's pretty simple until we step into the dawn of these protocols evolving. To sum it all up:

- Play to progress will be the next evolution of the play-to industry. What shape or form that comes in is entirely unpredictable.

- We will continue seeing incredibly aggressive models launched and marketed until the buyers are educated to the point of identifying the constant attacks their liquidity undergoes by being in such a poorly designed system.

- At the time of this article, I see no situation in which a protocol and its holders are best served focused on profit or liquidity generated. Time (labor) investment is the unarguable king of metrics.

- A system designed in layers is far more resilient to the impacts of the market that result in dead mechanisms for many play-to projects.

- Never put your money in a system that does not follow these guidelines. You know for a fact that there is an expiring clock. It is still impossible to determine when the expiring clock will stop. If you can't automate your position to exit in a plummet while you sleep, it's not worth the risk of involvement or even association. It will collapse.

- My grandma was right. These systems make no sense unless the impact of the person playing the game is the #1 priority at all times.

- Individuals who hound their favorite project/protocol with the request of "give me passive income." are early in the pSystem understanding journey. We must educate them on why passive income is not so black-and-white.

- There are hundreds of other aspects that a protocol must consider for a pSystem. We will be covering those in the coming weeks, not today.

While today it may be challenging to take this knowledge and immediately apply it to the things that you are building, you did just learn how to predict the future. The next time you're faced with the question of whether or not to put your money into a pSystem, you have all the tools you need to make the best decision possible without requiring the bias of an influencer.

Notes from Chance: This idea is going to take some time to settle in, I do realize that. I tried for 5 weeks to clean up this article and no matter what I do, it remains this monstrous accumulation of conclusions, concepts, and theories that currently result in nothing greater than a paradigm shift.

As the author of this article, I’ve failed you and I am unfortunately too dumb to educate you better than this today. If you have a question, ask it please so we can all refine our perspective. If you are reading this message, this article is still a living document and any newfound information will be added. In the coming weeks and months, I will be sharing the things I explore and learn in this part of the industry so that we can all move forward together.

If you made it this far, thank you. Welcome to the scribblings of a mad man.